Professional Indemnity (PI) Insurance is a vital safeguard for medical professionals, including doctors, nurses, and clinical officers registered with the Kenya Medical Practitioners and Dentists Council (KMPDC). It provides financial protection against claims arising from professional errors, omissions, or negligence during medical practice.

For KMPDC members, holding PI insurance is a regulatory requirement for licensing and annual practice renewal. This coverage ensures that healthcare professionals can focus on providing quality patient care while being protected from potential financial risks associated with malpractice claims.

By securing PI insurance, medical practitioners uphold professional accountability and demonstrate a commitment to patient safety and regulatory compliance, enhancing trust in the healthcare system.

What Is Covered

Professional Indemnity Insurance provides cover against legal liability claims that may arise as a result

of errors, omissions, misrepresentation or negligent advice provided in the course and scope of their

professional services. The insurance cover will also take care of defense costs associated with these claim(s)subject to the limit of liability purchased.

Who is Covered

The Professional Indemnity insurance for law professionals covers members who are:

- Are Registered & licensed by KMPDC.

- Provide medical services at a fee

- Practice practicing as per the applicable laws & regulations of the Republic of Kenya

Available Extensions

The cover may extend to also cover: Libel & Slander, Loss of Documents, Employee Dishonesty, Partners’ Previous Business and outgoing Partners at additional premiums.

Benefits of Professional Indemnity Insurance for Accountants

a. Financial Support

Professional Indemnity policy will cover court judgments awards and legal fees for defending yourself or the business

at the court of law. The policy may extend to also cover fees and other expenses that may arise from loss of documents.

b. Provides Peace of Mind

Professional Indemnity policy will increase confidence in carrying out the professional duty knowing that you have means

to defend yourself against any allegations for malpractice and defend your reputation thus enabling individuals and

companies to continue trading in successful businesses.

c. Enhance Brand Image & Credibility

Professionals are accountable for their services rendered and the professional Indemnity insurance provides support and

enhances goodwill as it prides confidence to your clients and investors knowing that any discrepancies that may arise in

course of your duty is covered.

d. Increased Chances of Winning Businesses

Most contractors and government authorities will put a minimum requirement for having a Professional Indemnity

Insurance to be considered in tendered businesses.

Requirements

- Duly completed & Signed proposal form.

- Copy of current practicing license(s)/ Certificate(s)

- Copy of CV, Pin certificates & National ID for individual practitioner

- For Firms: Copy of PIN certificates, incorporation certificate & CVs of partners and principals.

Why Chose our Agency

Competitive Premiums:

Our agency offers affordable rates without compromising coverage quality, helping you stay compliant while keeping costs manageable.

Fast and Efficient Service:

We prioritise quick policy issuance and renewals to ensure you meet KMPDC deadlines with minimal hassle.

Expert Guidance:

Our experienced insurance professionals understand the needs of medical professionals and KMPDC regulations, guiding you through policy selection and claims processes.

Trusted Underwriter Partnerships:

We collaborate with top-tier insurers known for reliability and prompt claims settlement, giving you peace of mind in case of a covered incident.

Ongoing Support:

Beyond policy issuance, we offer continuous support, including reminders for policy renewals and assistance with adjustments to your coverage as your practice grows.

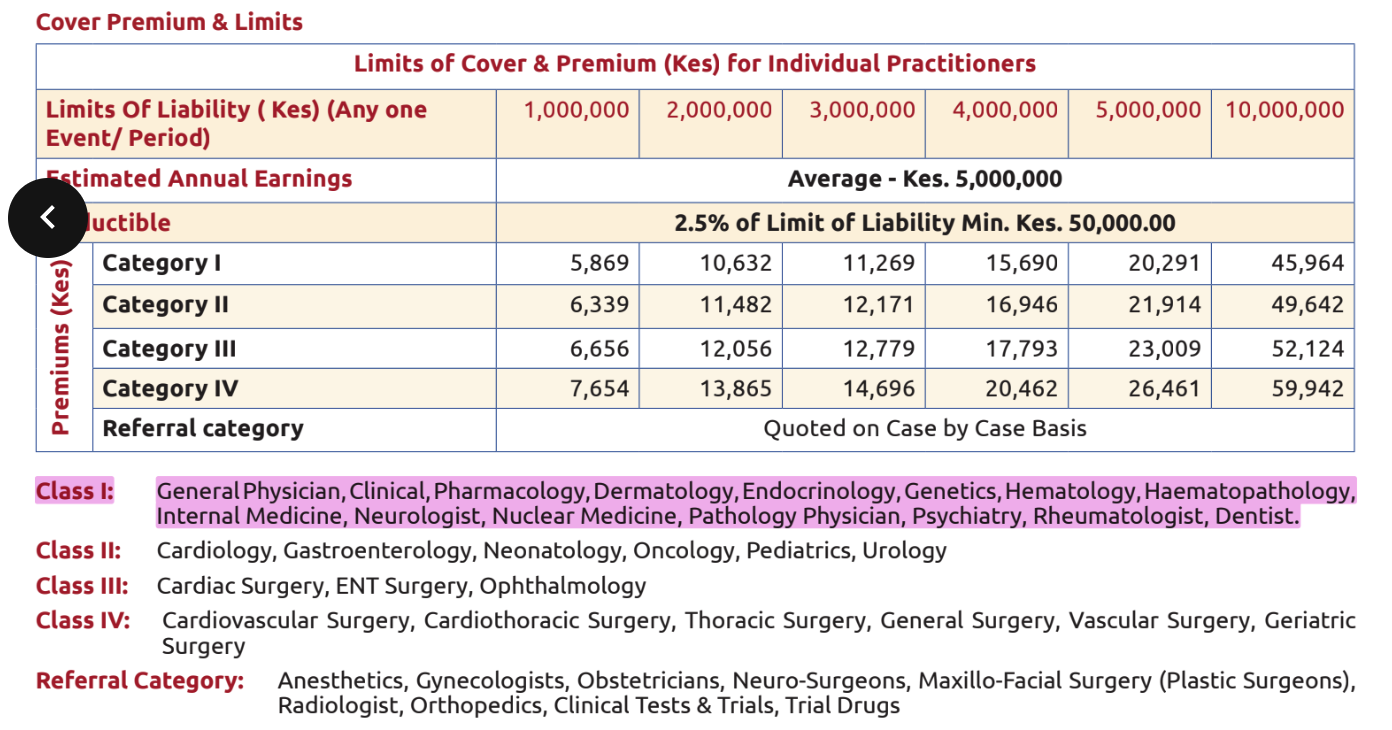

Premium Rates

The standardised premium rates are as follows, however get in touch with our team to get a conclusive quote that is inclusive of all statutory levies.

Contact us

You can get in touch with our team on the following contacts;

Email: [email protected]

Mobile: 0706600875 or 0208400601